kentucky lottery tax calculator

After you are done check out our guide on the best lottery prediction software for tools that will help increase your odds of winning - significantly. Weve created this calculator to help you give an estimate.

Usa Lottery Tax Calculators Comparethelotto Com

The lottery automatically withholds 24 of the jackpot payment for.

. In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. The table below shows the payout schedule for a jackpot of 145000000 for a ticket purchased in Kentucky including taxes withheld. The calculator will display the taxes owed and the net jackpot what you take home after taxes.

That means they are subject to the full income tax at a rate of 5. Imagine having to pay 28 in taxes on your precious lottery winnings. Although it sounds like the full lottery taxes applied to players in the United States that is the harsh condition for players of lottery games in India.

That may not sound like a lot but it adds up very quickly. Lottery tax calculator takes 765 on 2000 or more. 25 State Tax.

This varies across states and can range from 0 to more than 8. Recently the Mega Millions hit a whopping 1 billion. Just input the estimated jackpot amount select your state and our Mega Millions payout calculator will do all the rest.

This can range from 24 to 37 of your winnings. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot the statecity you live in the state you bought the ticket in and a few other factors. The taxes you will have to pay in order to receive your prize.

5 Louisiana state tax on lottery. There may be changes to the federal and state tax rate. Kentucky Capital Gains Tax.

If you win the jackpot you will be subject to the top federal tax rate of 37 percent. Tuesday Jul 26 2022. Lottery Winning Taxes in India.

The Lottery Tax Calculator- calculates the tax lump sum annuity payment after lotto or lottery winnings. Please note the amounts shown are very close approximations to the amount a jackpot annuity winner would receive from the lottery every year. This varies across states and can range from 0 to more than 8.

Current Mega Millions Jackpot. The tax rate is the same no matter what filing status you use. To use our Kentucky Salary Tax.

Additional tax withheld dependent on the state. Lottery tax calculator takes 765 on 2000 or more. The base state sales tax rate in Kentucky is 6.

However for the activities listed below winnings over 5000 will be subject to income tax withholding. One winner took the cash option and received 476 million. The tax rate is the same no matter what filing status you use.

Lottery tax calculator takes 699. This tool helps you calculate the exact amount. Believe it or not the tax used to be even higher at 309.

Lottery Calculator provides Federal and statelocal taxes and payout after Powerball Mega Millions winning. Lottery tax calculator takes 0 percent since there is no lottery in the state. Lottery tax calculator takes 6.

Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 4000000 and. Video of the Day. Lottery tax calculator takes 6.

Lottery Payout Calculator is a tool for calculating lump sum payout and. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. They are not intended to specify the exact final tax burden which.

For most counties and cities in the Bluegrass State this is a percentage of taxpayers. Kentucky imposes a 6 percent tax rate on all lottery winnings. Ternary operator with multiple conditions in angular.

Any other bet if the proceeds are equal to. A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money. 5 Kansas 5 Kentucky 5 Louisiana 425 Maine 5.

Any lottery sweepstakes or betting pool. Tastier star jellies cookie run kingdom Search. For example in 2022 three lucky Mega Millions players won a 900 million jackpot.

Kentucky Cigarette Tax. Probably much less than you think. If you held the winning ticket for that drawing you would have paid 60 million right off the top to the state of Kentucky alone.

Kentucky imposes a flat income tax of 5. Capital gains are taxed as regular income in Kentucky. Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself at home.

A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. Lottery tax calculator takes 6. Taxes on a 250000 lottery would be 17500 based on their states guidelines of 7.

Lottery tax rate is 65. This is still below the national average. The tax rate is the same no matter what filing status you use.

5 Kentucky state tax on lottery winnings in USA. So while the actual number of millions you will be given changes depending on the size of your prize and any applicable taxes a lottery annuity calculator can help you estimate what that means for you. You may then be eligible for a refund or have to pay more tax when you file your returns depending on your total income.

Overview of Kentucky Taxes. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes. Gambling winnings are typically subject to a flat 24 tax.

Usa Lottery Tax Calculators Comparethelotto Com

Free Gambling Winnings Tax Calculator All 50 Us States

How To Pay Taxes On Sports Betting Winnings Bookies Com

Usa Lottery Tax Calculators Comparethelotto Com

Usa Lottery Tax Calculators Comparethelotto Com

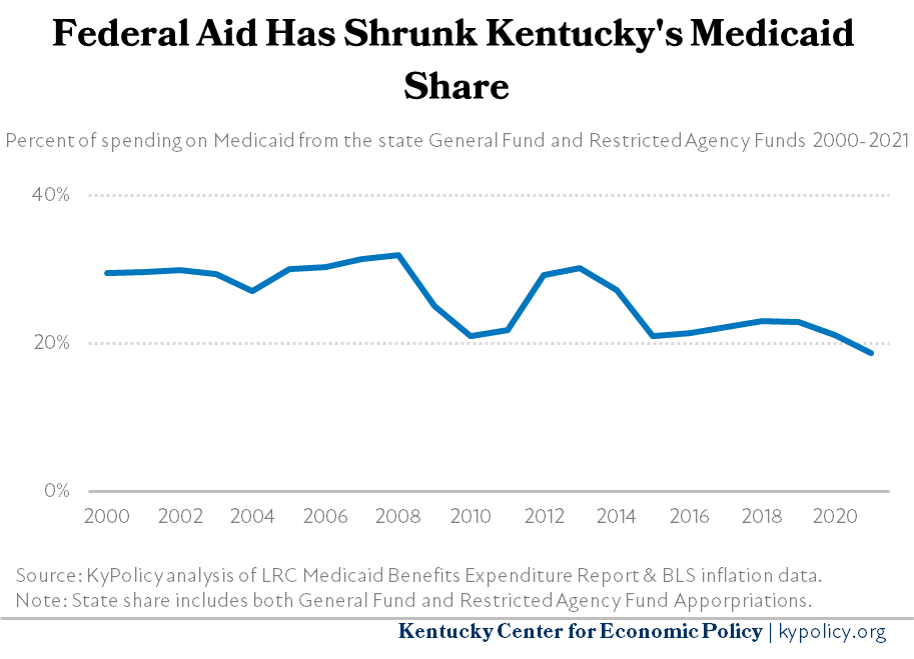

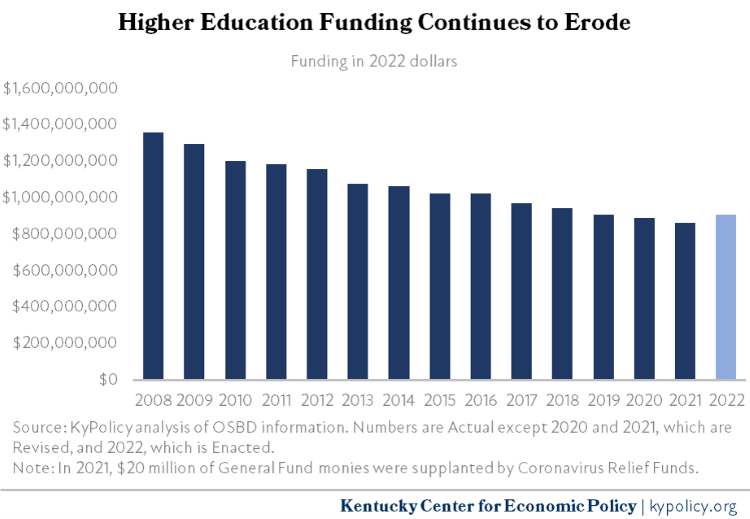

A Time To Invest Preview Of The 2022 2024 Budget Of The Commonwealth Kentucky Center For Economic Policy

Mega Millions Payout Calculator Charts For After Taxes Heavy Com

Megamillions Payout And Tax Calculator Lottery N Go

Usa Lottery Tax Calculators Comparethelotto Com

Megamillions Payout And Tax Calculator Lottery N Go

A Time To Invest Preview Of The 2022 2024 Budget Of The Commonwealth Kentucky Center For Economic Policy

Powerball How Much You Ll Pay In Taxes If You Win Money

Megamillions Payout And Tax Calculator Lottery N Go

Powerball Jackpot How Much Winners Pay In Taxes By State Money

Usa Lottery Tax Calculators Comparethelotto Com

Free Gambling Winnings Tax Calculator All 50 Us States